December 2024

Your Marketing Action Plan

The Marketing Action Plan is your go-to resource for new social posts and tips/best practices designed to help you grow your business.

SOCIAL GRAPHICS >

QUICK SOCIAL MEDIA GUIDE

Need help posting to social media? Click here for a step-by-step guide (Link opens in a new tab) to posting on a few of your favorite platforms. Reach out to your FMC for additional help.

For Internal Use Only. Not For Use In New York. Contact your FMC for updated captions.

December 1-7

Local Loan Officers

When it comes to securing home financing, it’s helpful to work with a local expert. Think of me as your neighbor with answers to all your mortgage questions. DM me to start the conversation!

Down Payment Tips

Ready set yourself up for homebuying success in 2025? It all starts with saving for your down payment. Here’s how to make it easier:

Holiday Hosting Hacks

Avoid getting lost in the details of planning, and take the stress out of hosting so you can spend more time with your family and friends.

Winter Homebuying

Winter is the perfect time to find your dream home! With fewer buyers in the market, you could have the upper hand when negotiating. Plus, imagine kicking off the new year in your cozy new space!

Ready to make your move? Let’s turn your winter home goals into reality. DM me to get started!

December 8-14

Homebuyer Wishlist

You’ve made a wish list for your future home, now let me help you check it twice! DM me to explore your mortgage options.

Home Appreciation

It’s no secret that buying a home is an investment in your future, and one piece to look forward to is home appreciation gains. Home appreciation gains are the increase in a home’s value over time. Often, a home’s appreciation can be influenced by inflation, changes in the real estate market and home improvements. An appreciation gain could help increase a home’s equity you can tap into for additional cash or turn a profit when selling. What would you do after your home appreciates? Tell me in the comments.

Winter Homeownership

Winter is a great time to go house hunting. With less competition from other buyers, it could be easier to schedule movers. Plus, you’ll have the opportunity to see how the house holds up in winter weather — checking for drafts and testing if the heating system can keep up with the cold. Call me to run some scenarios and get ahead of the winter buying game.

Mortgage Points

Mortgage points (also known as discount points) are upfront fees a borrower pays to a lender in exchange for a reduced interest rate over the life of their loan. One (1) discount point costs 1% of the loan amount. Each discount point may lower the interest rate as much as 0.25%, depending on product and loan characteristics. That could mean lower monthly payments! Connect with me today to learn more.

Top Renovations

The best thing about finally owning your own home is having the freedom to add your personal style to it. Some of the top renovations that first time homebuyers complete include a bathroom remodel, kitchen upgrades, and the installation of new flooring.

Have a renovation project in mind? Tell me in the comments, and we can work together to bring your dream home to life.

December 15-21

Mortgage Qualification

A qualification* is an estimate of what you may qualify for based on the information you provide to your lender. While not an actual approval yet until reviewed by an underwriter, this information can help you narrow your home search, plus show sellers that you're a serious buyer.

If you want to know how much home you could afford before you get qualified, try my free home affordability calculator at [[link to LO affordability calculator]] or call me to discuss your options.

*All loans subject to credit approval. A qualification is not an approval of credit, and does not signify that underwriting requirements have been met. Conditions and restrictions may apply.

Holiday Home Safety Tips

The holiday season is here, and you know what that means — decorations are out in full force! Here are our tips for how to avoid home safety issues when making your home festive:

Local Loan Officers

Making a big move? Don’t forget to PrimeLending help you finance your next home! Since PrimeLending is licensed to lend in all 50 states, you can expect the same simplified mortgage process wherever your next address is.

Let’s connect and talk about your plans.

$0 Down

Did you know it’s possible to buy a home with $0 down? With the right loan programs, like VA loans*, USDA loans, or certain down payment assistance programs**, you can achieve your dream of homeownership with little to no upfront costs. Contact me today to see how I can help you take the next step!

*Down payment waiver is based on VA eligibility.

**Certain restrictions apply, subject to down payment assistance program guidelines. Not available in all areas. Please contact your PrimeLending loan officer for more details.

Cash-Out Refi

A cash-out refinance* could be just what you need to gift yourself your dream kitchen! By replacing your current mortgage with a new loan at a higher amount, a cash-out refinance provides you with the difference in a lump sum that you can use however you want, including:

December 22-28

A Place to Call Home

If you're ready to give yourself the gift of homeownership, I'm here to make the mortgage process as simple as possible. With a catalog of more than 400 loan options, there's something waiting for you to discover. DM me today to start shopping for your future.

Benefits of Homeownership

Your home is the perfect stage for creating holiday magic! Owning a home makes it easier to accommodate guests in a warm, welcoming space. Plus, your home reflects who you are, making it the ideal backdrop for creating holiday traditions.

Invest in your home to make it the best place to celebrate and share joy this season!

Ready to find a place to create lasting memories? Send me a DM to get started.

Happy Holidays

Wishing everyone a happy holiday season! May this season bring you peace, joy, and meaningful moments with loved ones. #HappyHolidays

Credit Score

It’s time to talk about credit scores. Every credit score is composed of 5 factors, some of which are larger pieces of the overall puzzle. Here’s what goes into a credit score:

Kitchen Upgrade Ideas

Leave your outdated kitchen in 2024 and start the new year off with a fresh space you’ll love. Here are some ideas to get you started:

December 29-31

Holiday Budgeting

Saving for a down payment during the holiday season can make any budget feel tight. Here are some budgeting tips to help you enjoy the holidays while still working towards your down payment goals:

Renovation Resolutions

Is “renovate my home” on your 2025 vision board? Whether it’s upgrading your kitchen, adding an outdoor living space, or refreshing your interior, now is the perfect time to start planning your renovation resolutions.

Not sure how to get started with financing your project? I’m here to help. Drop your renovation loan questions in the comments.

Tax Benefits

Buying a home is a huge milestone with a big price tag. Luckily, there are tax benefits that come along with homeownership to help save money and offset some costs. When tax time rolls around, homeowners can deduct state and local real estate taxes as well as their mortgage interest payments. Remember to discuss all of your tax benefits with a tax professional.

If you want to learn more about the benefits of homeownership, let’s talk.

Fixer Upper

Taking on your first fixer-upper? Be sure to remember to:

Financial Checkup

As the year comes to a close, it’s a great time to run a mortgage checkup. Reviewing your mortgage can help identify opportunities to save money, shorten your loan term, or access equity for renovations, to pay off credit cards or other financial goals.

Whether rates have changed or your financial situation has evolved, a quick checkup can ensure your loan is still working in your favor.

Message me to get your free mortgage review and see how we can help you start the new year on the right financial footing.

DIY SOCIAL MEDIA TEMPLATES

Create your own social media posts using the provided canva template links.

Fall Festivals

There’s nothing better than fall in [city name]! Every year, I make sure to stop at these local festivals:

- List

Did I miss any? If you know of a fun area festival, drop it below.

Best Outdoor Patios

We better get out and enjoy our patios in [city name] while we can! I like to cheer on the [fave football team] at [place]. If you like to take your fur baby with you, [place] has an amazing dog-friendly patio. Have recommendations? Let me know where your favorite patios are in the comments.

RECRUITING POSTS FOR ENGAGING TOP TALENT

Recruiters and branch managers, use the posts below to engage with potential recruits.

Grow with us this holiday season

Give yourself the gift of a new career this holiday season! We’re growing our team and we have a seat saved for you. Better tools, better products and better technology are all waiting for you. Experience the PrimeLending difference at https://www.joinprimelending.com/.

PrimeLending Benefits

Our benefits aren’t just perks — they’re a testament to our commitment to your success and well-being, including:

- Comprehensive coverage for your health and financial security.

- Work-life balance through flexible schedules and generous PTO.

- Cutting-edge resources to help you thrive in your career.

- Collaborative culture where your voice matters and you always feel supported.

Elevate your career with a team that values you. Explore more at https://www.joinprimelending.com/benefits.

A New Company for the New Year

Start the new year with a fresh opportunity at a company that truly invests in your success. At PrimeLending, we empower loan officers with industry-leading tools, a supportive team culture, and a strong reputation built on decades of excellence.

When you join PrimeLending, you’ll gain access to cutting-edge marketing resources, dedicated operational support, and a commitment to your professional growth. It’s not just a job — it’s a place where you can thrive.

Ready to make a move? Let’s chat about how PrimeLending can help you achieve your goals in 2025 and beyond. https://www.joinprimelending.com/contact-us.

PrimeLending University

Class is always in session at PrimeLending University where you can start leveling up your career from day one. Whether you want to grow your leadership capabilities, refine your technical skills, or explore new areas of expertise, you can get it all at PrimeLending University. Contact us today to learn more https://www.joinprimelending.com/contact-us.

PrimeLending Growth

This year, our herd grew stronger than ever. Our team spans the country, which is fitting since we are licensed to lend in all 50 states. Will you be the next one to join the team? Learn more at https://www.joinprimelending.com/.

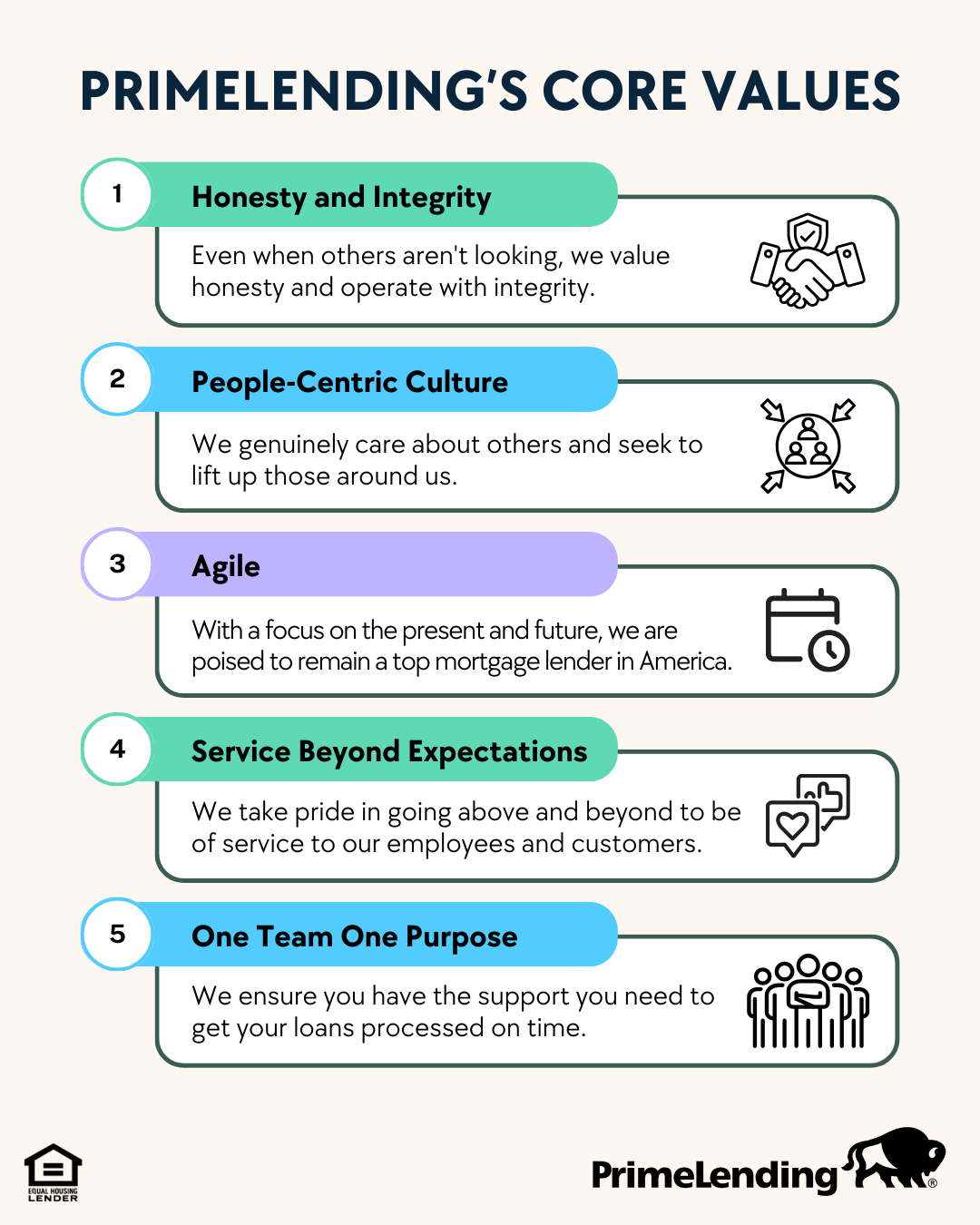

PrimeLending's Core Values

Our core values are more than words on a wall — they’re the foundation of everything we do. We believe in creating a culture of teamwork, building trust through integrity, delivering results with service beyond expectations, and making a meaningful impact in the communities we serve.

From day one, you’ll be met by a team that shares your dedication to excellence and a company that values your contributions. Join PrimeLending and take your career to a place where values truly matter. Let’s talk about how you can make an impact with us — reach out today https://www.joinprimelending.com/contact-us.

We're Hiring

Ready to elevate your career? PrimeLending is looking for experienced, driven professionals to join our dynamic team. Here’s why you’ll love working with us:

- Competitive benefits that prioritize your well-being and financial future.

- A collaborative culture where your voice is heard and success is celebrated.

- Cutting-edge technology and tools to help you thrive.

- Opportunities to make a real impact on homebuyers and communities.

Be part of a company that invests in you. Apply today and start your next chapter with PrimeLending! https://www.joinprimelending.com/.

Videos >

Video Tips and Scripts That Speak to your Audience

One of the best ways to build a connection with customers and business partners is to share your personality via videos. Check out our Video Best Practices Guide to help you get started, including content ideas, Chat GPT prompt ideas, disclaimer requirements, video do's and don'ts and more!

Visit our Video Scripts for Loan Officers to view all available scripts!

TBD Conversation Starters

Encouragement is the secret sauce that keeps your customers hooked! Check out these fun conversation starters guaranteed to keep the energy and excitement flowing.

Download

3 Reasons to Buy Instead of Rent

If you're currently on the fence about buying a house, I get it...it's a big step, after all. But the benefits of homeownership are pretty hard to top when compared to renting. In fact, here are three reasons why you should stop renting and go ahead and buy instead. Number one: your monthly mortgage could be less than what you're spending on rent. Many people assume that owning a home isn't affordable compared to renting, but that's not always the case. Number two: low down payment options. It's a myth that you need to put twenty percent down to buy a house. There are actually several mortgage programs you may qualify for that only require you to put down as little as three to five percent. Plus, you can use gifts and grants toward a down payment. Three: buying is an investment. Unlike renting, when you own a home, you're building equity because houses typically increase in value over time. I'd love to go over more advantages with you and help you get the right home. Get in touch with me today to get started.

Download

FTHB Loans Script

[Greeting of your choosing]! If you're a first-time homebuyer, you might be wondering how to get started on your homeownership journey. Well, the good news is that there are special loans available just for you!

First-time homebuyer loans can help make your dream of owning a home a reality. These loans often have lower down payment requirements and more flexible credit score criteria, making them a great option for those just starting out.

There are a few popular first-time homebuyer loans — FHA, USDA and conventional loans. Each of these have their own perks to them, FHA loans have low down payment options available. USDA loans are designed for those buying a home in a rural area and offers zero down payment, and conventional loans have competitive interest rates.

Homeownership is closer than you think! If you're interested in learning more about your options, don't hesitate to reach out to us. Let's get you into a home!

Download

Reno Purchase

Many of homebuyers struggle when it comes to finding that perfect house. Sometimes it's just really challenging to find a home that meets everything on your wish list. But you don’t have to give up yet. The good news is that you still hyave an option you may not have considered before...with a PrimeLending renovation loan, I can help you transform a fixer-upper into your perfect home. With this type of loan, you can upgrade appliances, create an open floorplan, make kitchen and bathroom updates...the list goes on and on. You can even roll the costs of repairs or upgrades into your mortgage, which means repairs can begin immediately after closing. So if you come across a house with great bones that needs some work, dream big and try to picture its potential. Don't hesitate to get in touch with me to learn more.

DownloadTIPS >

TIPS + BEST PRACTICES TO GROW YOUR AUDIENCE

Posting on Each Platform

Need help posting to social media? Click below for a step-by-step guide to posting on a few of your favorite platforms. Reach out to your FMC for additional help.

Posting from Total Expert

- Login to TE and navigate to: Web Marketing > Social Media > Create New

- Pick your social post and click: Actions > Share

- Fill out the information and Share your post

Top Marketing Habits

Hear what some of the region's top LOs are doing frequently that keeps them top of mind and gets them ahead of the competition. Led by Kaylee Holdge, FMC from Desert District, the session will include loads of great tips and best practices from loan officers in the Desert District team.

For Internal Use Only. Not For Use In New York.